Term Insurance

Term life insurance provides coverage for a specific period of time. A term life insurance policy issues a payment to a beneficiary only if the policyholder dies while the policy is in effect and if they have paid their premiums on time and in full.

Term life insurance policies are commonly contracted for a term of

10 to 30 years

, although shorter or longer terms can be available with some policies. If the policyholder outlives the length of the contract, the policy expires and no payout is made.

Certain term life insurance policies may be converted to a whole life insurance policy at the end 2 Columnof the term. Some term life insurance policy may be able to be renewed at the end of the term.

Unlike

permanent life insurance

, term life insurance policies do not accrue a cash value. For this reason — and the fact that term policies expire — term life insurance rates are generally more affordable than certain permanent life insurance policies.

The earlier you purchase a term life insurance policy and the healthier you are, the more affordable the premiums will likely be.

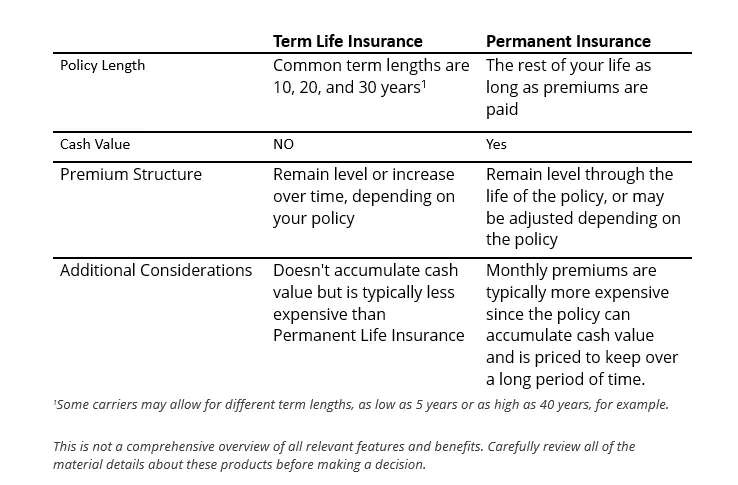

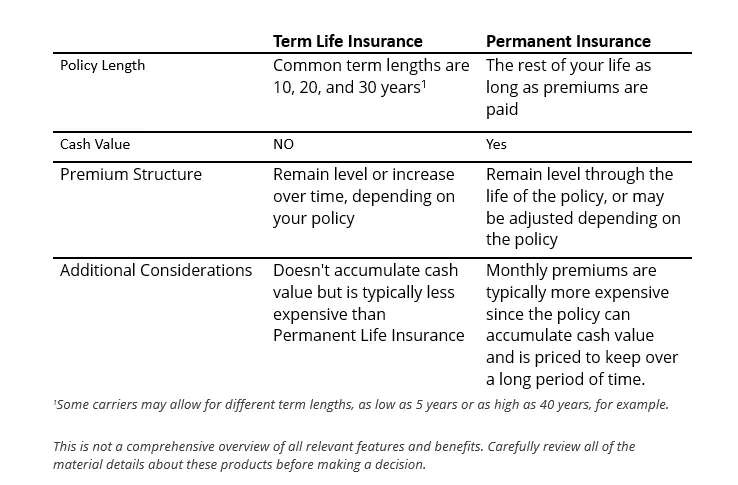

This chart helps to illustrate some of the primary differences between term life insurance and permanent life insurance policies.